why is actblue not tax deductible

Yes count me in. If you have an ActBlue Express account we make it easy for you to find your.

Monica Martinez Fundraiser Babylon Democratic Committee

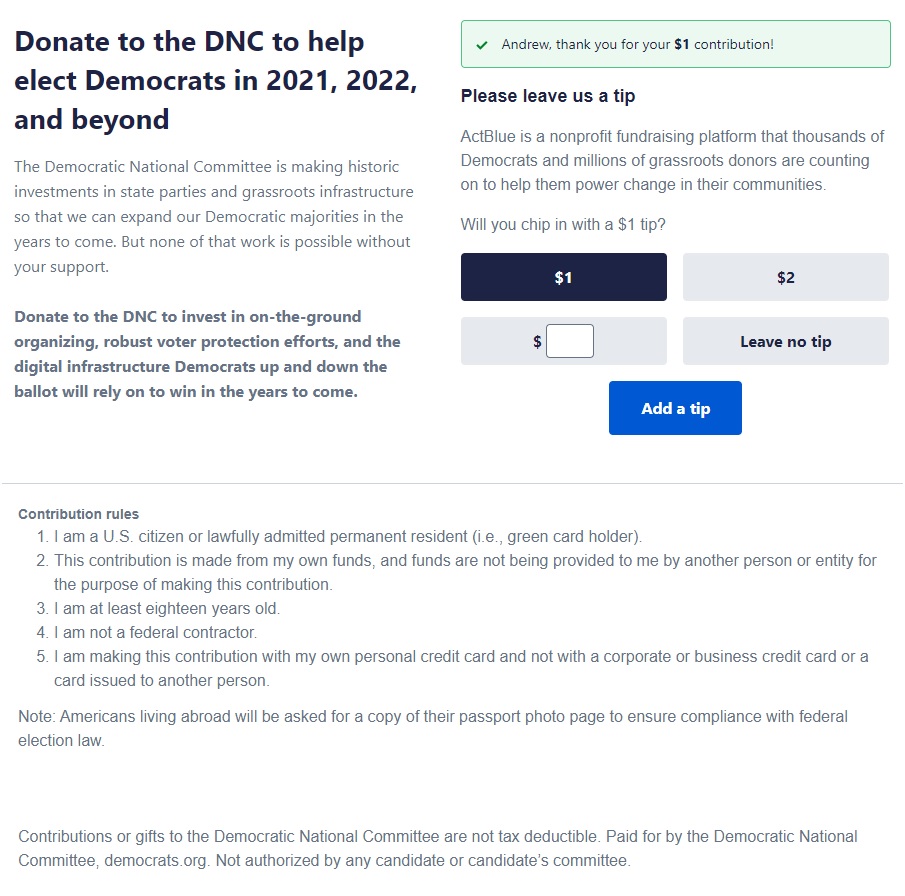

ActBlue is a United States political action committee established in June 2004 that enables anyone to raise money on the Internet for the Democratic Party candidates of their.

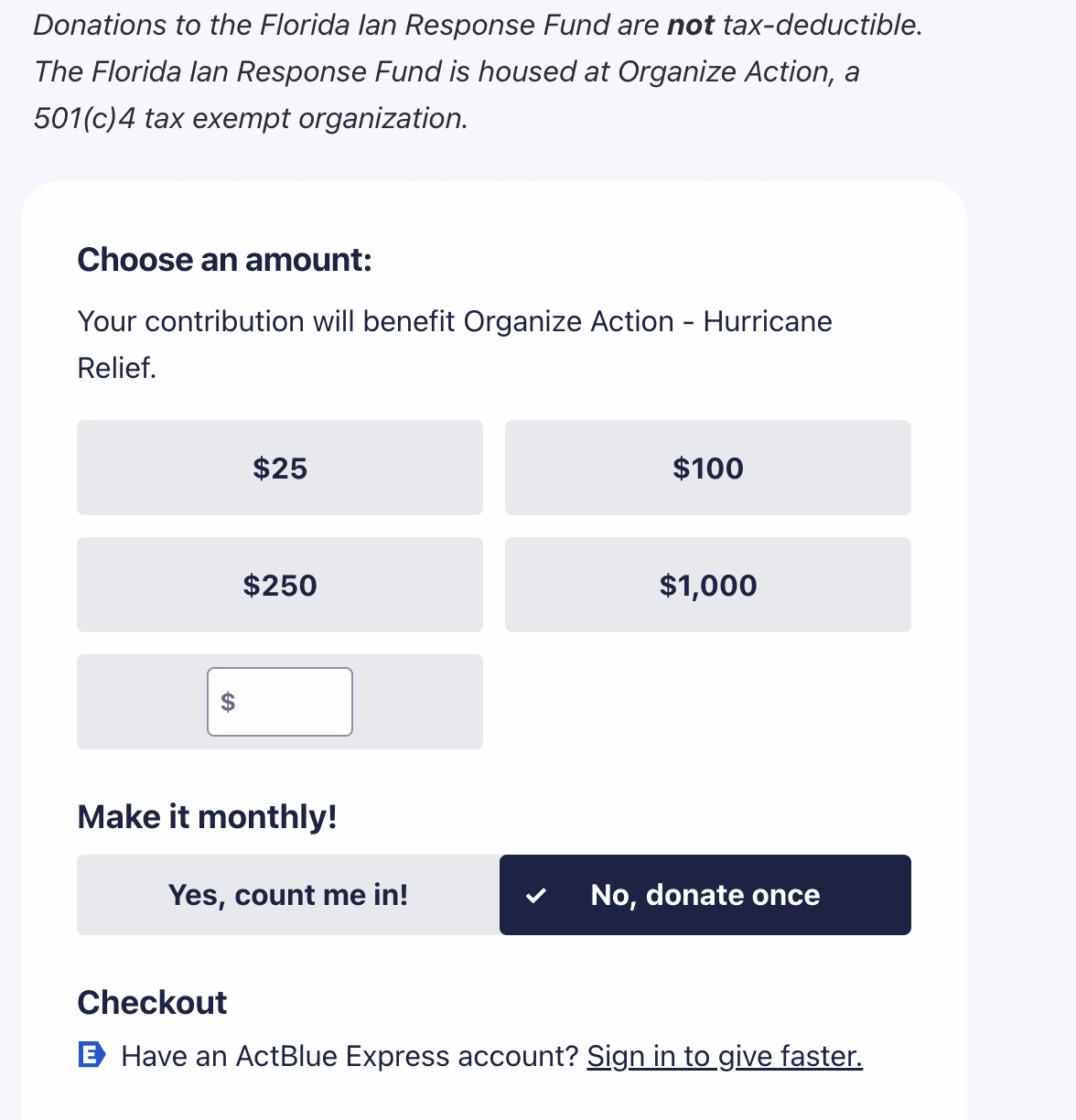

. However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. Theres just a 395 processing fee on all transactions. As for donations the laws have been altered in recent years where you cant write off contributionsdonations EVEN CLOSE to how you were once able to and I.

Truthesda 2 yr. The larger the depreciation expense the. Theres just a 395 processing fee on all transactions.

ActBlue Charities is a qualified 501 c 3 tax-exempt organization. Contributions or gifts to actblue are not deductible as charitable contributions for federal. A companys depreciation expense reduces the amount of earnings on which taxes are based thus reducing the amount of taxes owed.

ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent. The absence of a score does not indicate a positive or negative assessment it only indicates that we have not yet. Your contribution will benefit Ed Markey.

10 35 50 100 250 500 1000.

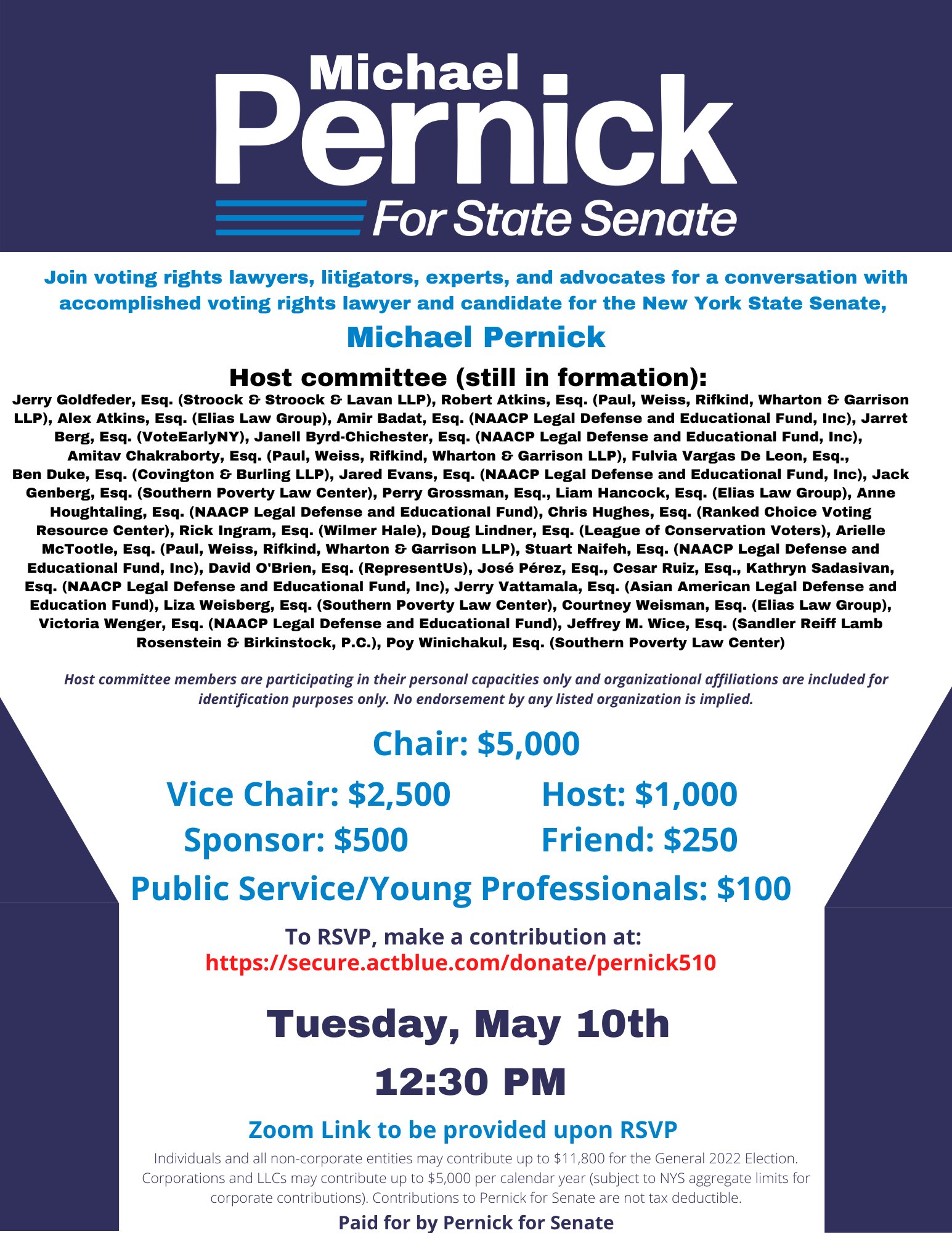

Michael Pernick Michael Pernick Twitter

Actblue Billions Raised Online Since 2004

Republican Candidates Have No Idea What Actblue Is Mother Jones

C A Dutch Ruppersberger Donate Via Actblue

Veronica Escobar Donate Via Actblue

Screen Shot 2019 03 04 At 11 09 34 Am Democratic Party Of Virginia

Democratic Fundraising Powerhouse Actblue Amassed Nearly 150 Million From Small Donors With Misleading Sales Pitch Documents Show The Daily Caller

Faqs About Blueprint By Swing Left

Pac To The Future Donate Via Actblue

A Fundraiser In Support Of Senator Casey Democratic Jewish Outreach Pa

Upcoming Events The Howard County Democratic Central Committee Hcdcc