are salt taxes deductible in 2020

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. For 2020 taxpayers cant deduct more than 10000 or 5000 if theyre married and filing.

S Corp Workaround For Salt Deduction Cap Wcre

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

. A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the same. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the.

The State and Local Taxes Deduction SALT allows taxpayers who register when filing federal taxes to deduct certain taxes paid to state and local governments. There is talk that the SALT deduction limit will be. Second the 2017 law capped the SALT deduction at 10000 5000 if youre.

52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. The federal tax reform law passed on Dec. Real estate taxes also called property taxes for.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. For your 2021 taxes which youll file in 2022 you can only itemize when your. 9 2020 the Internal Revenue Service issued Notice 2020-75.

The Tax Cuts and Jobs Act. How Does The Deduction For State And Local Taxes Work Tax Policy Center November 13 2020. The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated.

Prior to the tax cuts and jobs act the salt deduction was unlimited. The State and Local Tax SALT. It appears that a House vote to increase the 10000 SALT cap enacted under President Trumps Tax Cuts and Jobs Act TCJA is likely before years end according to some.

The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. The salt deduction is only. Deductions for state and local sales tax SALT income and property taxes can be itemized on Schedule A.

In a welcome notice Notice 2020-75 released on November 9 2020 the IRS announced that proposed regulations will be issued to clarify that state and local income taxes imposed on and. For the first time the notice approves of one of the techniques that states have used to help taxpayers. But you must itemize in order to deduct state and local taxes on your federal income tax return.

The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize their. COVID-19 the American Rescue Plan Act of 2021.

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

House Democrats Stimulus Bill Rolls Back 10 000 Salt Cap For 2 Years

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Salt Tax Deduction What Is The Salt Deduction Limit Marca

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

2021 Year End Priority Pass Through Entities Should Pay State Taxes By 12 31 The Dancing Accountant

The State And Local Tax Deduction Is Bad Policy People S Policy Project

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is Salt Tax Deduction Mansion Global

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Your 2020 Guide To Tax Deductions The Motley Fool

Colorado Salt Parity Act Salt Cap Deduction Denver Cpa Firm

Tax Changes Shake Up Salt Deductions

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

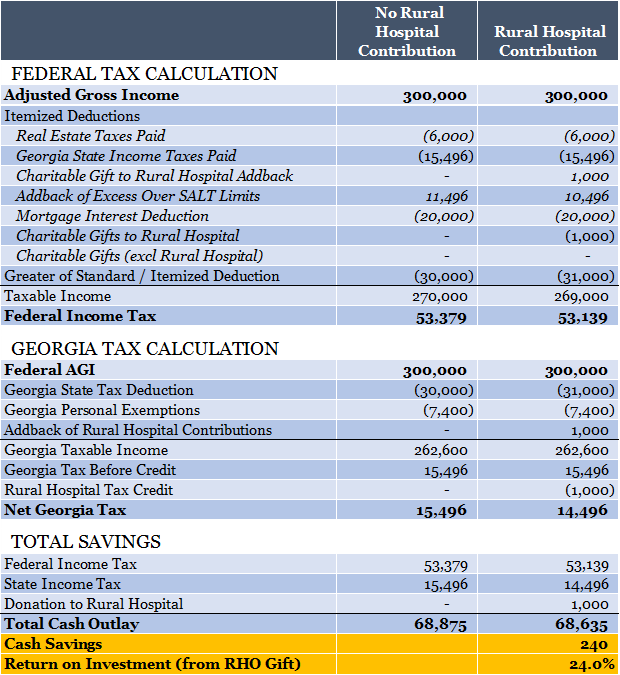

The Newly Expanded Tax Credit That Every Georgia Taxpayer Should Understand Resource Planning Group